Capital Gains Tax Domain Name Sale

Can I do a 1031 asset exchange to shelter some of mu taxes by purchasing more silver coins from the sale of the domain name to shelter some of the capital gains. Subtract that from the sale price and you get the capital gains.

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2021 Propertycashin

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2021 Propertycashin

If however you waited just one more month to sell it it would count as a long-term capital gain and be taxed because of the gains value and your income at the 15 long-term capital gains rate.

Capital gains tax domain name sale. Seller is in the 25 income bracket so they pay a 15 capital gains tax on the profit. Or am I totally off the ball. If more then 12 months your looking at only having to pay tax on half of the sale due to the 50 capital gains tax discount.

The market for domain name purchases and sales offers indisputable evidence that domain names appreciate in value. Can domain name sales be qualified as capital gains. When you sell your primary residence 250000 of capital gains or 500000 for a couple are exempted from capital gains taxation.

Typically the sale or trade of a capital asset is taxed at the capital gain or loss tax rate. Short-term capital gains happen when you sell an investment property you held for one year or less. Digital automated services means any service transferred electronically such as over the Internet using one or more software applications.

Consequently the taxpayers capitalized costs of acquiring a domain name that is registered as a trademark whether acquired as a separate asset or as part of the acquisition of a trade or business are an amortizable Code Section 197 intangible. If you bought the site your basis is the sale price setting aside depreciation. I will have a 150000 capital gain on the sale of a domain name.

Answer The first step in how to calculate long-term capital gains tax is generally to find the difference between what you paid for your property and how much you sold it foradjusting for commissions or fees. Seller of website owes 600 at tax time. For investors this can be a stock or a bond but if you make a profit on selling a car that is also a capital gain.

If you have more than 3000 in excess capital losses the amount over 3000 can be carried forward to future years to offset capital gains or income in those years. Best case you can claim the cost of renewals and registration to save a few bucks. The basis cost to create the website including the domain is 2500.

I consider it part of my collectible business DBA that includes other collectibles such as silver coins vehicles etc. That means you pay the same tax rate on short-term. If youre selling a property you need to be aware of what taxes youll owe.

Depending on your income level your capital gain will be taxed federally at either 0 15 or 20. If the amount you realize which generally includes any cash or other property you receive plus any of your indebtedness the buyer assumes or is otherwise paid off as part of the sale less your selling expenses is more than your adjusted basis in your home you have a capital gain on the sale. Accordingly these capitalized costs may be amortized.

50000 - 20000 30000 long-term capital gains. Read on to learn about capital gains tax for primary residences second homes investment properties. The basis equals the amount you put into any asset in this case your website and the capital gain equals the difference between your sale price and the basis.

Because sale of a domain name would be considered a sale of digital automated services it would be subject to sales or use tax. In order to determine the capital gain tax you will pay you must first determine your basis. These gains are taxed as ordinary income.

Because they satisfy the two-factor test the increase in their value should be deemed capital in nature and the tax treatment applicable to capital gains and losses should apply to domain name sales. Capital gains tax is the tax imposed by the IRS on the sale of certain assets. I hope you made a lot of money from the sale of your website.

Worst case you need to include 5000 on your tax return. Conversely the sale or trade of a non-capital asset is taxed at the ordinary gain or loss tax rate. If capital losses exceed capital gains you may be able to use the loss to offset up to 3000 of other income.

Are there any documents I should provide to the IRS when I do my taxes. This is generally true only if you have owned and used your home as your main residence for at least two out of the five years prior to the sale. The taxable amount is 6500-2500 4000.

I owned a domain name for more than one year so Im thinking I can get the long-term tax rate on the sale income.

Love Dilbert Financial Advisors Website Features Advisor

Love Dilbert Financial Advisors Website Features Advisor

Http Www Stumbleupon Com Su Adslsd 6sutjr Mtw 0o V Www Youtube Com Watch V V Y8u25y980 Illinois State Tax Inc Capital Gains Tax Tax Debt Tax Accountant

Http Www Stumbleupon Com Su Adslsd 6sutjr Mtw 0o V Www Youtube Com Watch V V Y8u25y980 Illinois State Tax Inc Capital Gains Tax Tax Debt Tax Accountant

Capital Gains Tax On Inherited Property Bhhs Fox Roach

Capital Gains Tax On Inherited Property Bhhs Fox Roach

Create Your Sale Deed On Legalraasta Within Minutes Go To Our Website And Choose From The Available Forms We Will Help Legal Services Legal Agile Marketing

Create Your Sale Deed On Legalraasta Within Minutes Go To Our Website And Choose From The Available Forms We Will Help Legal Services Legal Agile Marketing

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Capital Gain Investing

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Capital Gain Investing

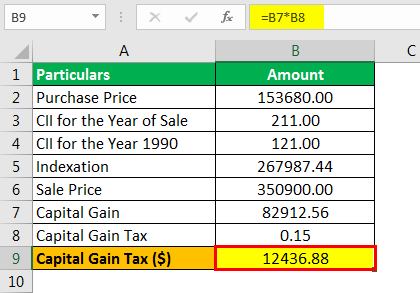

Indexation Formula How To Calculate Adjusted Price

Indexation Formula How To Calculate Adjusted Price

Rta An All Inclusive Solution For Mutual Fund Investors Posts By William Damians Mutuals Funds Mutual Solutions

Rta An All Inclusive Solution For Mutual Fund Investors Posts By William Damians Mutuals Funds Mutual Solutions

How To Build Your B2b Brand Branding Process Internet Marketing Business Web Design Company

How To Build Your B2b Brand Branding Process Internet Marketing Business Web Design Company

Heretake Com How To Memorize Things Online Real Estate Online Marketing

Heretake Com How To Memorize Things Online Real Estate Online Marketing

What Taxes Are Involved When Selling My Online Business

What Taxes Are Involved When Selling My Online Business

Capital Gains Tax Calculator Capital Gains Tax Calculator Exchangeright

Capital Gains Tax Calculator Capital Gains Tax Calculator Exchangeright

Profit And Loss In Running A Business Graphic By Setiawanarief111 Creative Fabrica Business Company Business Illustration Business

Profit And Loss In Running A Business Graphic By Setiawanarief111 Creative Fabrica Business Company Business Illustration Business

How To Use Gmail With Your Own Custom Domain Business Blog Online Business Marketing

How To Use Gmail With Your Own Custom Domain Business Blog Online Business Marketing

Pin On Business Tips For Small Business Owners

Pin On Business Tips For Small Business Owners

10 Long Term Capital Gain Tax To Benefit P2p Lending Players Read Our Complete Article Published On Moneycon Peer To Peer Lending Money Lender Personal Loans

10 Long Term Capital Gain Tax To Benefit P2p Lending Players Read Our Complete Article Published On Moneycon Peer To Peer Lending Money Lender Personal Loans

20 Types Of Taxes In India Types Of Taxes Capital Gains Tax Tax

20 Types Of Taxes In India Types Of Taxes Capital Gains Tax Tax

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Business Chart Annual Business Report Chart Showing Financial Performance Sponsored Annual Business Business C Investing Mutuals Funds Stock Market

Business Chart Annual Business Report Chart Showing Financial Performance Sponsored Annual Business Business C Investing Mutuals Funds Stock Market

Post a Comment for "Capital Gains Tax Domain Name Sale"